von Sebastian | Apr. 21, 2023 | Blog

If you are a fan of Nicholas Taleb’s books just like me, you know that things like market predictions, fearing or crying about financial armageddons, and all that other noise about the behavior of the market is non-productive, speculation and basically a complete waste of time.

(mehr …)

von Sebastian | Apr. 13, 2023 | Blog

There is this thing going on in our heads: A talking voice. Ever heard? It’s complaining, suggesting, thinking weird stuff, cursing and so on. It’s called our mind. It’s known to be brilliant; it’s supposed to be the most important thing in our lives. Yet, people are constantly annoyed by it. And there are actually people out there who want (or want to teach) of how to shut it up.

So I have some good news and some bad news about the mind.

(mehr …)

von Sebastian | Apr. 7, 2023 | Blog

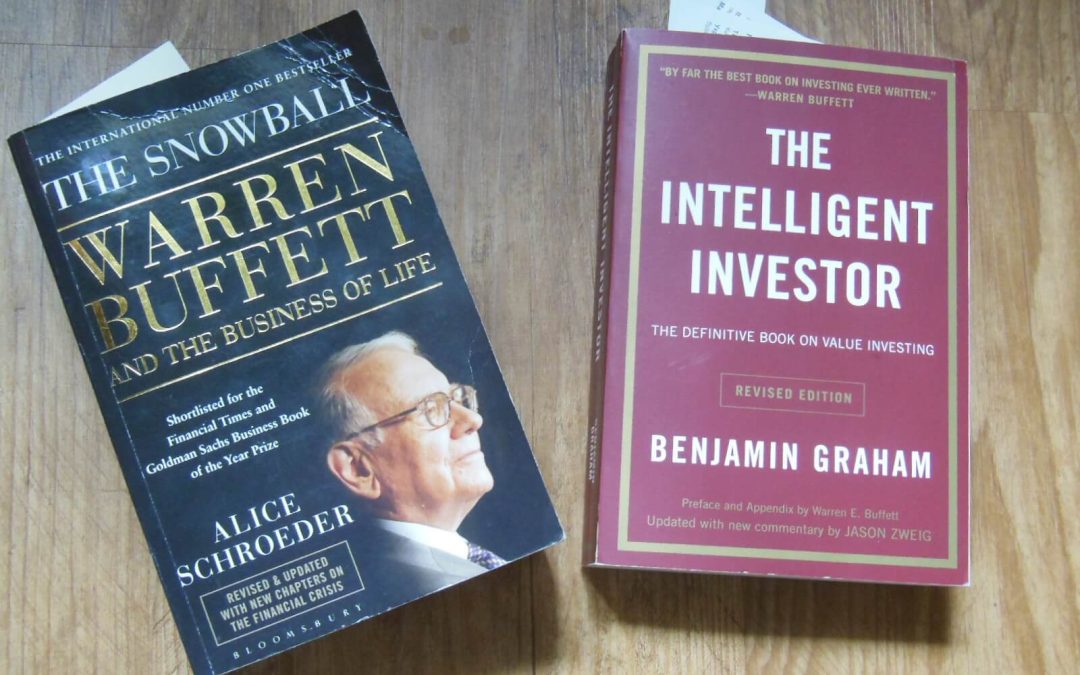

Do You Think Like Warren Buffett And Benjamin Graham?

I recently finished the mammoth book “The Snowball” – the biography of Warren Buffett, written by Alice Schroeder.

I bought this book around 6 or 7 years ago, but I just managed to read it now in 2023. So out of curiosity I viewed some of the negative reviews on Amazon. Most people disliked the “irrelevant and boring stories” and that you allegedly get no insights. Ha ha, this is so not true! Poor people!

(mehr …)

von Sebastian | März 31, 2023 | Blog

The world is full of claims, promises and visions — either explicit or implicit. We better be able to navigate through this noise in order to make good decisions. One way we could do this is by pure belief: We see a commercial that shows how a lotion is effective against dry skin. The actors in the commercial are the only reference we have, so when we buy it, we do this out of pure belief.

(mehr …)

von Sebastian | März 24, 2023 | Blog

The internet is full of questions and advice concerning the right ETF mixes in relation to saving rate and time frame.

The discussions usually go like this: “I’m X years old, have such and such ETFs at the moment with Y savings-rate in my portfolio, and expect to die at the age of Z.

Am I doing the right things (ETF choices and saving rate)? Will the money last? Which ETFs should I hold, which one sell? Etc.”

Besides ETF’s, these type of questions can be find with all other assets as well.

But to me, this approach is not ideal, however, it indicates the typical beginner’s discussion.

(mehr …)